Life is just wonderful.

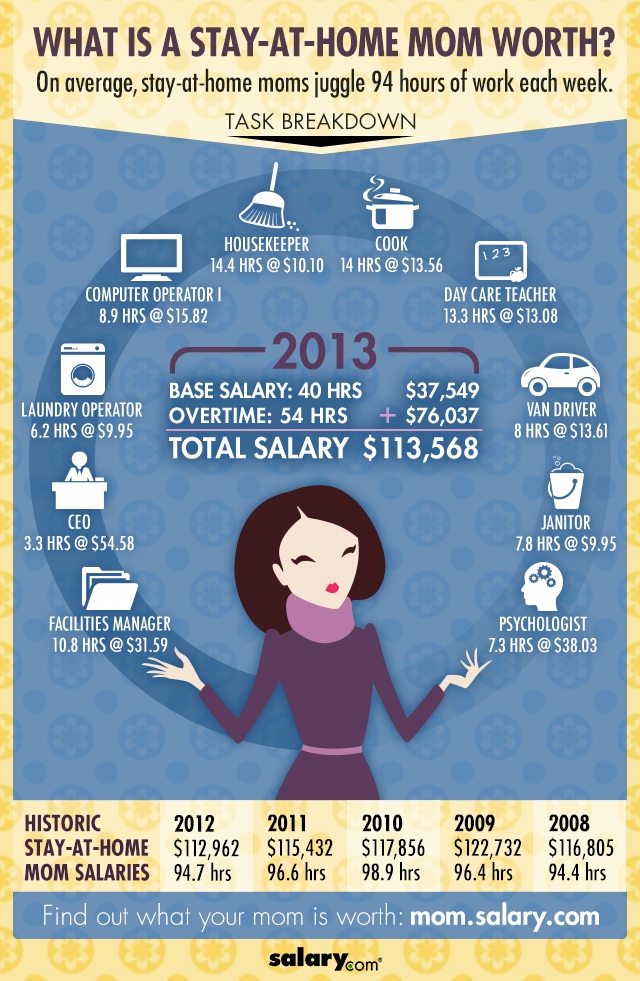

George and Jane have now gotten married. They have purchased their home and they have 3 children and everybody is doing what they’re supposed to be doing and life is wonderful. When George and Jane sat down to run the numbers on the daycare costs and the pre-school/post-school costs, and all the extra things that need to happen in any of our homes (Jane is only one person trying to keep up with the demands of 5), it came to their attention that they would be dollars ahead after taxes if Jane were to stay home and provide the quality of life that they would not get if she chose not to stay home.

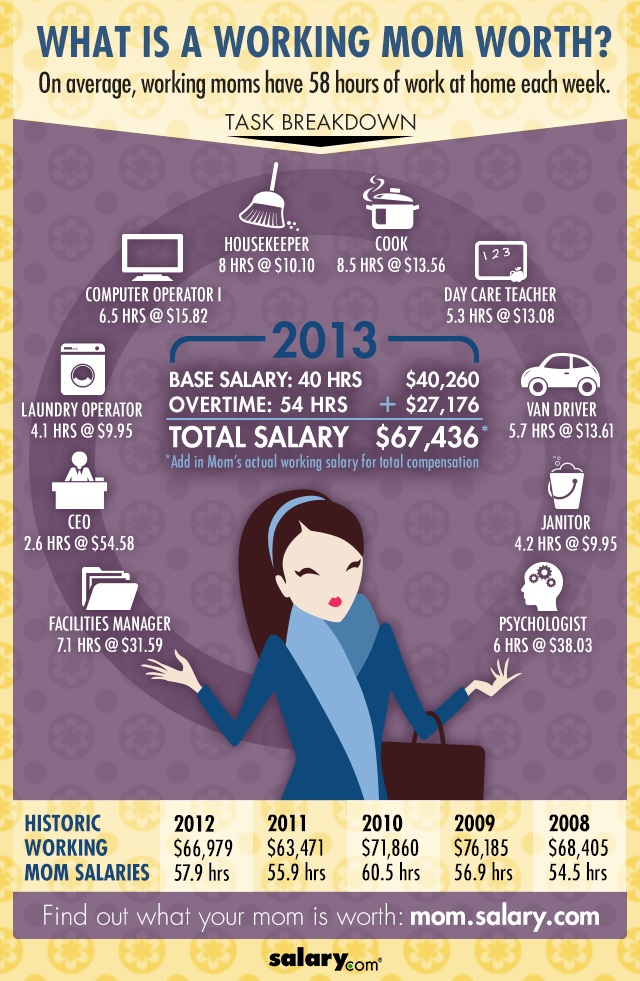

In my previous post, if anything would happen to Jane, George would need to replace Jane’s efforts. In referring to the Department of Labor, I came across this link from salary.com that gives the infographics on what mom’s chores are valued at. I cannot encourage you enough to sit down with an independent agent and look at every insurance bucket there is and find out what do I have, what do I need and what do I want, and have within your budget, and within reason, your bases best covered. I see people that are over insured in one area, no insurance in the next and it seems to be a patchwork quilt that has been put together over the course of time by whomever was in front of them at that time.

Recent Comments