Your human resource person’s responsibilities now include administrating benefits for the employees (administration side of that job). That includes a lot more expertise, training, compliance and liability than ever before.

So, if I think of the HR person, whether that is your spouse, a hired employee or an entire department, whoever was responsible for these HR duties, typically had two sides to their job. We had the strategic side which included hire, attract and retain, quality employees for your business. Subsequently, there was testing and training whether this be on the job or in a classroom so that your employee could be most efficient and productive for your business. The strategic side of the HR person’s job also consisted of employee termination and possibly succession planning.

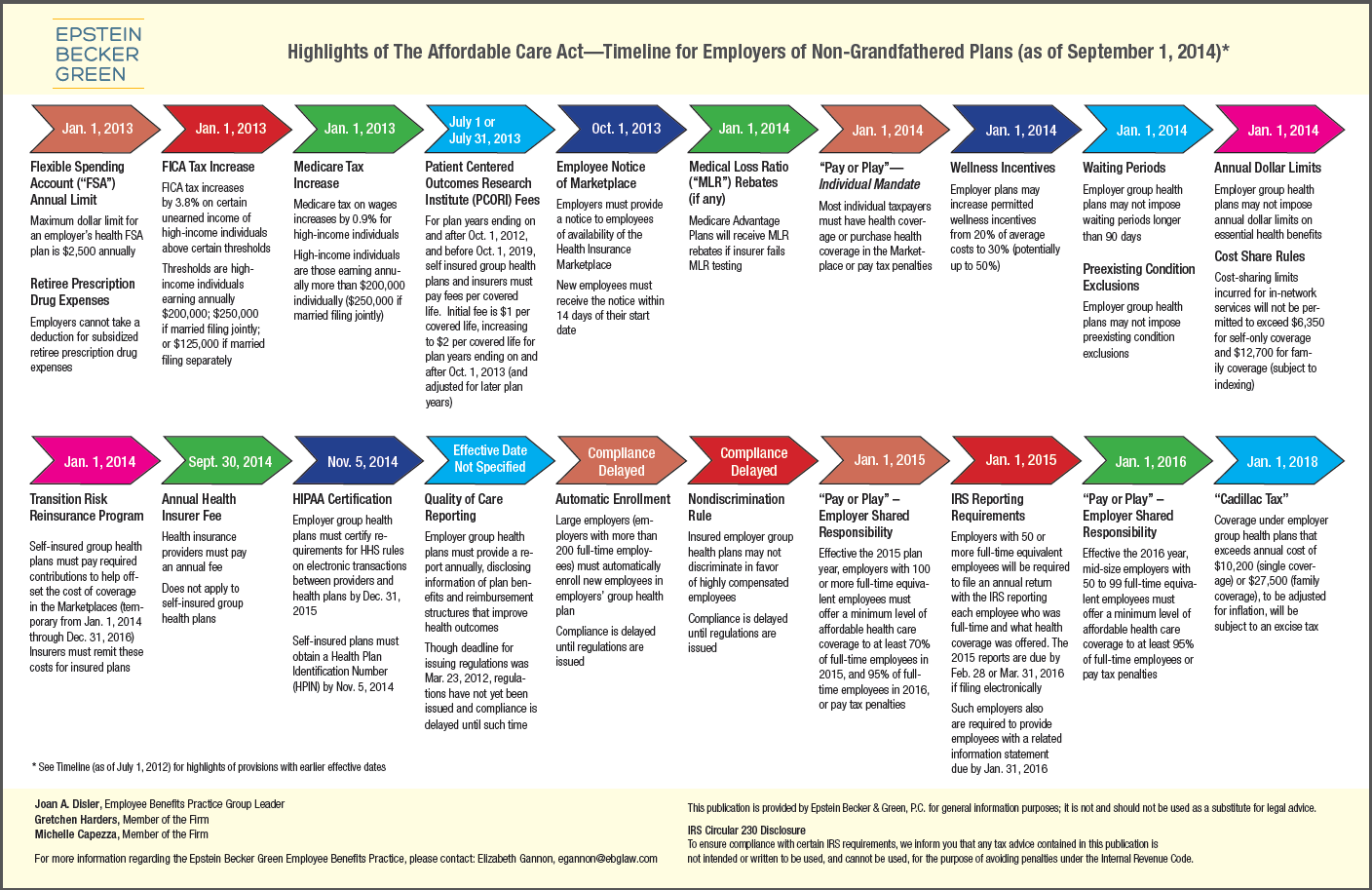

There’s also the administrative side of this person’s job. On the administrative side, a few things that come to mind would be enrolling the new hire (and possibly dependents) onto your group benefits platform of products. It would be removing them, COBRA administration, from wage garnishments to payroll, IRL liens, proper compliance with all of the current regulations in place, testing, non-discriminatory issues and 401(k) administration, to name a few. Consequently, with the new regulations, and laws that are now in place, it only makes good sense to address the liabilities your company has.

It’s highly recommended that this be done prior to any violations. My suggestion would be, leave the same people doing the same job that you’ve always had them do and call me for a consultation. It is possible to leave your same plan in place, if you choose to. We can examine and analyze your needs, your wants and your budget and make recommendations for planned changes, if it’s appropriate, in an attempt to save you premium dollars and transfer the liability of all of the administrative side of this person’s job to myself as a seasoned, licensed, experienced insurance broker. There are no fees associated with this offering. And my goal for all of my business owners is to keep everybody productive, maximize your dollars and reduce your liability. Please call me for your free assessment.